HONG KONG, Dec 16 – In 2025, China will begin using Washington’s technology sanctions against its Asian neighbors. The United States’ restrictions on semiconductor imports and other critical goods have hindered advancements in artificial intelligence in China, the world’s second-largest economy. Now, China is beginning to retaliate. With its significant influence over major corporations in Japan and South Korea, China is in a strong position to target these countries.

In 2022, U.S. President Joe Biden initiated broad measures to block China’s access to advanced semiconductor chips and related manufacturing technology. Since then, these controls have been expanded to include a wider range of equipment and materials, including machines and tools from the Dutch firm ASML and Japan’s Tokyo Electron. In December, the Biden administration added over 100 Chinese companies to its trade blacklist as part of its expanded sanctions.

The growing restrictions have forced Beijing to take action. In mid-2023, China began requiring export licenses for essential materials such as gallium, germanium, graphite, and antimony—key components in the production of batteries, semiconductors, fiber optics, and military weapons. However, a closer inspection of trade patterns revealed that Chinese authorities were not systematically denying export licenses, according to Cory Combs, a researcher at Trivium China. That situation is about to change. In retaliation to the latest U.S. sanctions, the Chinese government has now imposed a complete ban on the export of some of these crucial materials to the United States—marking its most severe countermeasure yet.

Further retaliatory measures are anticipated as China continues to fall behind in the field of artificial intelligence. Leading local tech companies such as Tencent and Baidu are depleting their reserves of Nvidia chips, which are now banned, and will soon be forced to turn to domestic alternatives to train their AI models. However, the latest chip developed by Huawei, China’s most promising semiconductor company and its best answer to Nvidia’s highly sought-after graphics processing units (GPUs), is reported to be three generations behind the $3.3 trillion market leader in the United States, according to Bloomberg.

Amidst these developments, Beijing has been subtly preparing to leverage its near-monopoly over rare earths and critical minerals as a strategic weapon. In June, the Chinese government introduced a series of regulations aimed at safeguarding the country’s rare earth resources. These regulations cover mining, smelting, and trading activities, and establish state control over the country’s rare earth assets.

The latest export ban issued by China’s Ministry of Commerce follows a significant revision of previous policies. Unlike earlier, fragmented restrictions on gallium and germanium, the new unified system imposes stricter government oversight on technologies and materials that could be used for both civilian and military applications. Businesses selling specific types of graphite, essential for electric vehicle batteries, are now required to disclose details about their overseas customers and the intended use of the materials. Following the U.S. model of sanctions, China will also introduce a “control list” of foreign companies subject to additional restrictions and licensing requirements.

Targeting American companies like Micron Technology and Tesla, especially when China’s struggling economy desperately needs trading partners, foreign investment, and technological expertise, could prove to be counterproductive. In 2023, Chinese infrastructure companies were banned from purchasing certain memory chips from Micron. However, despite this, a year later, the Idaho-based company has strengthened its ties with China, with CEO Sanjay Mehrotra meeting with the Minister of Commerce and even laying the foundation for a new factory in the country in 2024. Meanwhile, Tesla’s sales in China are projected to grow by 14%, reaching $23 billion by 2025, according to Visible Alpha forecasts.

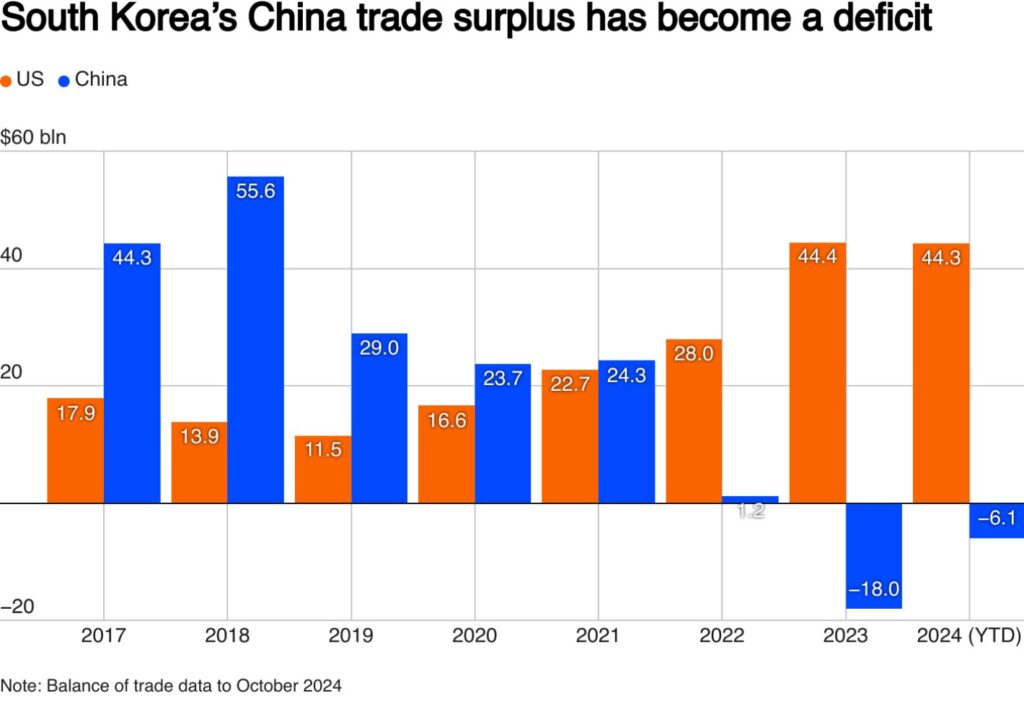

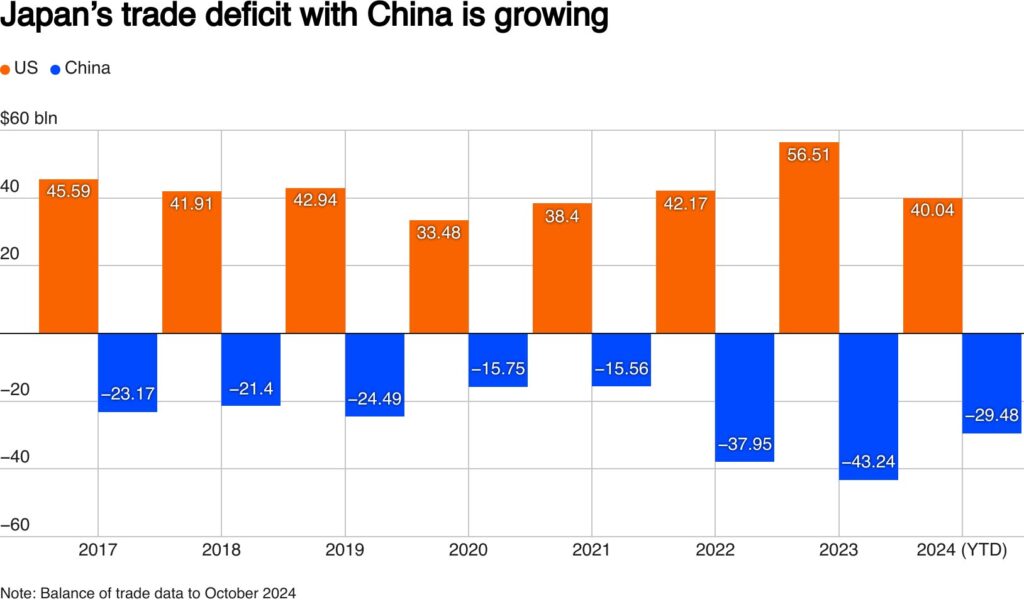

On the other hand, Beijing holds much greater leverage over its U.S. allies in Asia. A Japanese government white paper revealed that Japan relies on China for nearly a third of its imports, while the United States is only dependent on China for 13%. These imports include machinery, organic chemicals, and electrical equipment. Despite official efforts to reduce reliance on China, a separate study found that South Korea’s dependence on China for five out of the six raw materials needed for semiconductor manufacturing actually increased in 2023.

This situation places corporate giants in Tokyo and Seoul in a precarious position. Toyota, for instance, has expressed concerns that China might cut off its access to vital minerals, which are crucial for the $220 billion automaker’s operations, according to Bloomberg reports from September. Along with its supply chains, Toyota also has manufacturing facilities in mainland China. South Korea’s leading memory chip producers, SK Hynix and Samsung Electronics, as well as battery specialists LG Chem and SK On, face similar challenges.

Even the mere threat of export controls could make these countries reconsider their stance on supporting the tech war against China. Beijing is well-equipped with a range of countermeasures, and by 2025, it will be focusing them on U.S. allies.

By Zukhrakhon Mansurova

Leave a Reply