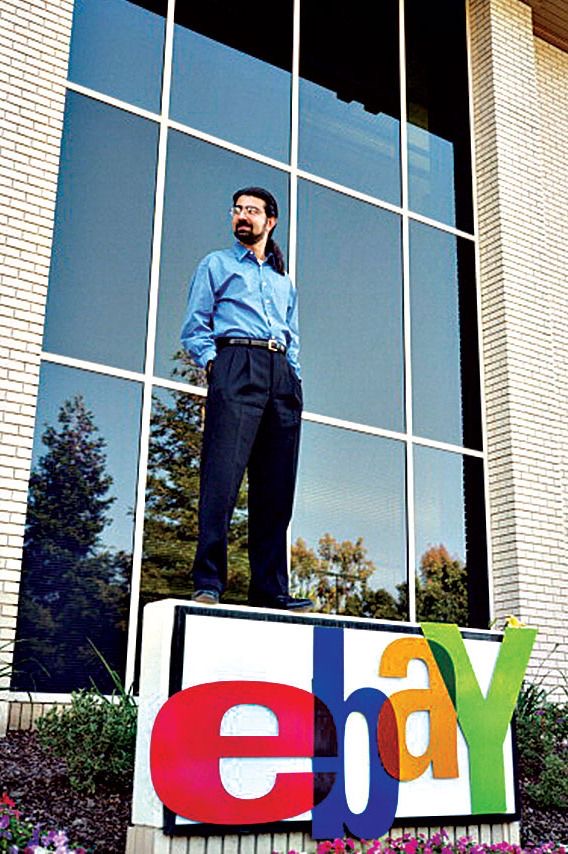

At the inception of eBay, critics mocked Pierre Omidyar’s idea, dismissing it as merely an online version of a flea market where $10 trinkets were sold. Little did they imagine that the company’s market valuation would one day soar to $31 billion.

Pierre Omidyar, the founder of eBay, was a software engineer born in Paris to an Iranian family. Early in his career, he worked for a startup that facilitated online sales for established corporations. Realizing that his work failed to benefit everyday people, Omidyar sought a way to contribute meaningfully. This led to the creation of an accessible online marketplace where users could freely buy and sell second-hand goods. The platform was named eBay, incorporating a user feedback system that fostered trust and mutual respect among buyers and sellers.

Imagine this: you list an item you no longer need, others bid for it, and you sell it effortlessly — an entirely novel concept in 1995, when the internet was still in its infancy. Omidyar’s unique approach humanized the platform; he saw its users not as mere contributors to profit but as real people engaged in daily life.

During the day, Omidyar continued his regular job as a software engineer, while at night, he tirelessly worked on eBay. He introduced new features, organized sections, and provided guidance to ensure that the platform was efficient and user-friendly. This dedication laid the groundwork for the company’s eventual success.

Unexpected Growth

By early 1996, eBay’s rapid growth overwhelmed Omidyar’s internet account, surpassing bandwidth limits. To sustain the platform, Omidyar appealed to the community, asking sellers — who were already profiting from the site — for voluntary contributions. Though initially free, his candid request for small payments resonated with users. What began as a trickle of checks soon turned into a flood of contributions.

By the end of the year, eBay was generating over $400,000 per month, a remarkable achievement considering the negligible investment.

Omidyar’s vision, grounded in trust, transparency, and a genuine understanding of people, transformed a hobby into an unprecedented success, paving the way for a multi-billion-dollar empire.

Why Spend on Marketing?

Pierre Omidyar eventually left his day job and hired two assistants. He streamlined his website, renamed the auction platform eBay, and witnessed a staggering 40% growth each month. However, what fueled this growth was even more surprising.

Unlike Yahoo and other companies spending heavily on marketing, eBay spent nothing on advertising. Instead, its exponential expansion aligned with Metcalfe’s Law: as the auction network grew, its value increased exponentially. More sellers posting items attracted bargain-hunting buyers, and as buyers grew, so did the number of sellers. Unlike telecom networks reliant on external hardware, eBay retained 100% of its auction profits.

Omidyar leveraged the network effect — and importantly, he owned the network. The platform’s profits were so high that it didn’t even need external venture capital.

However, Omidyar, being a programmer, struggled to manage the rapidly growing platform. Understanding his limitations, he turned to Bruce Dunlevie, co-founder of Benchmark Capital, who had helped him previously with his online ventures. Dunlevie introduced him to Benchmark founder Bob Kagle.

Kagle valued eBay at $20 million and proposed a $6.7 million investment.

Wealth or Trust?

Omidyar could have sold his shares to a newspaper network for $50 million. However, instead of chasing wealth, he valued trust and aligned with Kagle, who understood his vision. Omidyar wasn’t looking for money but for a partner to help manage the platform effectively. The funds he received were simply kept as a reserve.

A Woman at the Helm

To strengthen eBay’s leadership, Meg Whitman was appointed CEO. With her retail experience and eBay’s strong network effect, she transformed the startup into a global powerhouse. In 1998, eBay went public, and its stock skyrocketed, making Benchmark and other investors massive returns.

Record-Breaking IPO

In September 1998, eBay’s shares debuted at $18 and soared to $47 on the first day. By October, shares hit $73 after consistent growth. By 1999, eBay’s market value reached $21 billion, with Benchmark’s stake valued at $5.1 billion — a historic return on a $6.7 million investment.

Pierre Omidyar’s commitment to serving people first drove eBay’s success and turned its founders into billionaires.

Laylo Khondamirovna

Leave a Reply